Independent Risk Management Constitutes One of the Two Core Functions When it Comes to Alternative Investment Fund Management.

We offer comprehensive risk management services, either as appointed AIFM or on a stand-alone basis as delegated risk management function. Additionally, we also provide turnkey risk management services to asset managers who manage accounts of investors requiring AIFMD-equivalent risk analytics.

Our proficient risk management team has implemented a state-of-the-art risk management framework covering all aspects of the substantial legal and regulatory requirements imposed by the AIFMD.

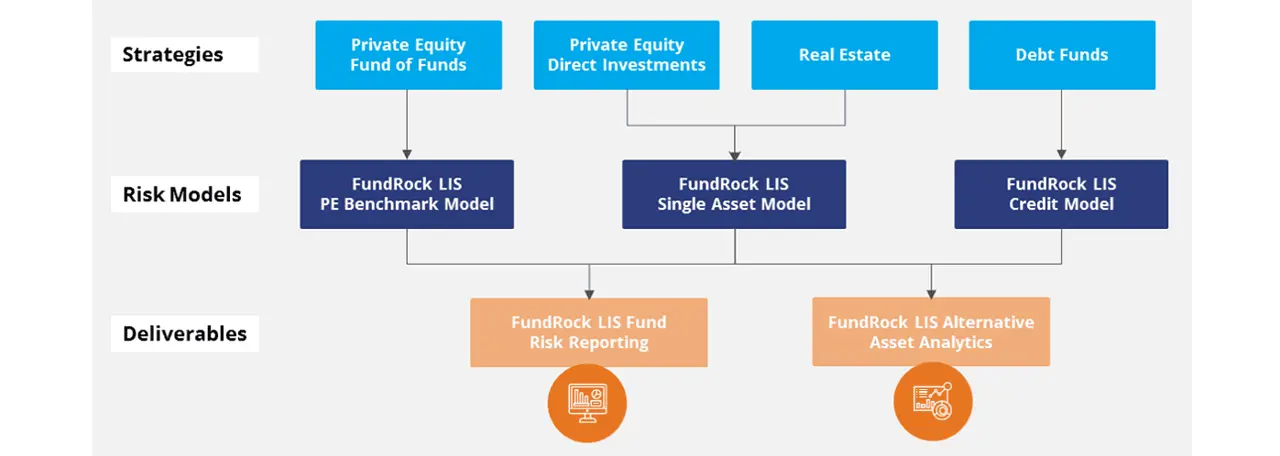

In order to add additional value for our clients, we have developed proprietary quantitative risk models for investments in real assets and debt. Notably, our risk models are designed to be consistent across asset classes and compatible with standard models prevailing in the liquid world (Value-at-Risk). This facilitates both investors and portfolio managers of alternative investments to integrate such risk metrics into their existing asset allocation and risk management framework.

Beyond periodic standard risk reporting, we offer on request additional bespoke risk analytics to asset managers and institutional investors in order to support them in analyzing risk and performance of real asset investments in-depth.